Growth Advice

- Call us: +91-11-40815200

- Email: contactus@smcwealth.com

Growth Advice

Portfolio Management Services (PMS) is a sophisticated investment vehicle that offers a range of specialized investment strategies to capitalize on opportunities in the market. SMC Private Wealth offers PMS as an investment vehicle for select investors with an option to personalize and customize portfolios through investment mandates. We also offer equity Portfolios which look to generate capital appreciation by investing in a diversified portfolio of equity or equity-related securities. These portfolios are structured to suit different risk profiles of customers.

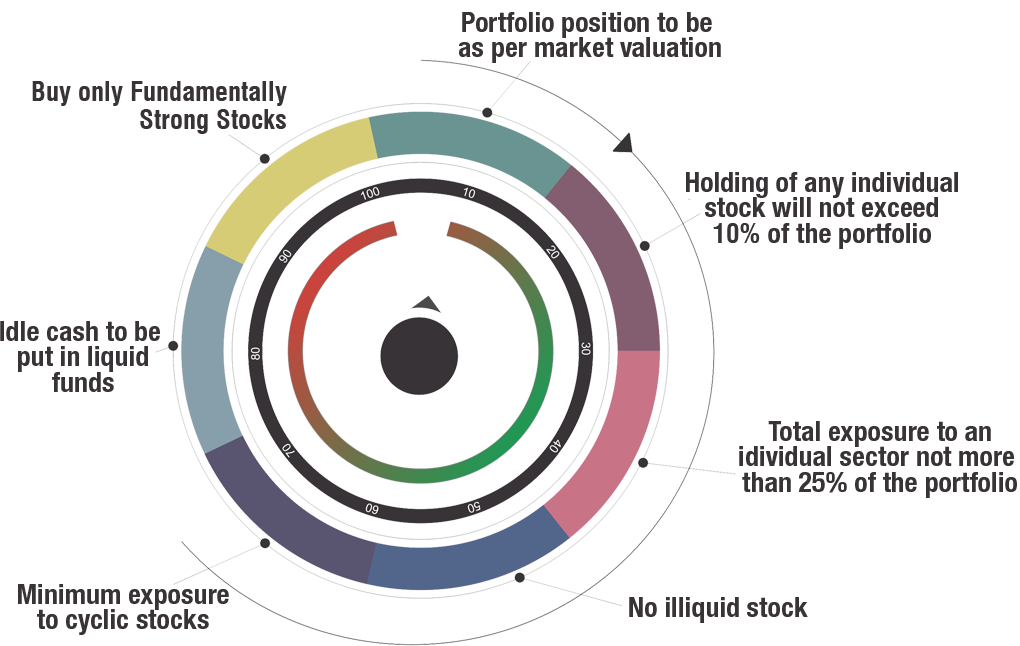

Buying fundamentally sustainable growing businesses and outperform the benchmark indices by investing in equity and equity-related instruments including mutual funds.

| Scheme Security | Portfolio Category | Wtg |

|---|---|---|

| Reliance Industries Ltd | Refineries | 5 |

| Techno Electric & Engineering Company Ltd | Construction & Engineering | 5 |

| State Bank of India | Banks | 4.5 |

| Syrma SGS Technology Ltd | Industrial Machinery | 4.5 |

| Aptus Value Housing Finance India Ltd | Finance | 4 |

| Deep Industries Limited | Miscellaneous | 4 |

| Enviro Infra Engineers Ltd | other | 4 |

| HDFC Bank Ltd | Banks | 4 |

| Larsen & Toubro Ltd | Civil Construction | 4 |

| Mahindra & Mahindra Ltd | Automobiles | 4 |

*Data as on 31st Oct. 2025

| Performance (Return TWRR) |

1 M (%) | 1 Yr (%) | 2 Yrs (%) | 3 Yrs (%) | 4 Yrs (%) | 5 Yrs (%) | SI |

|---|---|---|---|---|---|---|---|

| Growth (TWRR Unitised) | 6.20 | 0.88 | 14.16 | 14.98 | 11.42 | 19.47 | 14.97 |

| Customise Portfolio (TWRR Unitised) | 5.44 | -1.93 | 14.96 | 14.32 | 8.05 | 0.00 | 7.27 |

| BSE 500 TRI | 4.27 | 5.32 | 19.61 | 16.19 | 12.99 | 21.05 | 18.00 |

| Moderate Equity (TWRR Unitised) | 4.82 | 6.64 | 16.94 | 16.06 | 14.96 | 23.73 | 16.97 |

| NIFTY 50 TRI | 4.62 | 7.59 | 17.50 | 13.90 | 11.16 | 18.57 | 15.72 |

**Performance of strategy is calculated for live accounts on TWRR method as on 31st Oct 2025. *YTD: Calendar Year 2025 | Above 1 year returns are CAGR

All clients have an option to invest in the products / investment approaches directly, without intermediation of persons engaged in distribution services.

Clients can directly approach us by sending an email on contactus@smcwealth.com